Benefits of approaching OBG Outsourcing

OBG Outsourcing accounting services involves delegating financial tasks to third-party service providers, often located offshore or in specialized accounting firms. This approach offers numerous benefits for businesses of all sizes, ranging from startups to large corporations. One of the primary advantages is cost savings. By outsourcing functions, companies can significantly reduce overhead costs associated with hiring and maintaining an in-house accounting team. This includes expenses related to salaries, benefits, training, and infrastructure.

Accounting professionals

Moreover, outsourcing allows businesses to tap into the expertise of highly skilled professionals without the need for extensive recruitment efforts. In the UK, where the demand for qualified accountants often outstrips supply, our OBG outsourcing provides access to a vast talent pool of accounting professionals with diverse skill sets and industry experience. This ensures that businesses receive high-quality financial services tailored to their specific needs, whether it's bookkeeping, tax preparation, financial reporting, or strategic financial planning.

Requirements

Another compelling reason for outsourcing accounting services in the UK is compliance with regulatory requirements. The UK has stringent financial regulations imposed by authorities such as HM Revenue & Customs (HMRC) and the Financial Reporting Council (FRC). Navigating these regulations requires specialized knowledge and expertise, which may not be readily available within an organization. OBG Outsourcing functions to providers with a thorough understanding of UK financial regulations help businesses stay compliant and avoid costly penalties or legal issues.

Efficiency and flexibility for businesses

Furthermore, OBG outsourcing accounting services can enhance operational efficiency and flexibility for businesses. Third-party providers often leverage advanced technologies and automation tools to streamline processes and improve accuracy. This enables faster turnaround times for financial tasks, allowing businesses to make timely decisions based on up-to-date financial data. Additionally, outsourcing provides scalability, allowing businesses to easily adjust the level of accounting support based on fluctuating demand or business growth.

However, while the benefits of OBG outsourcing accounting services are clear, it's essential for businesses to carefully evaluate potential risks and considerations. One common concern is data security and confidentiality. Entrusting sensitive financial information to third-party providers requires robust security measures and strict confidentiality agreements to protect against data breaches or unauthorized access. Businesses should thoroughly vet outsourcing partners and ensure they adhere to industry best practices for data protection and compliance.

Moreover, communication and collaboration can pose challenges when outsourcing accounting services, especially when dealing with offshore providers in different time zones. Effective communication channels and project management processes are essential to ensure seamless collaboration and maintain transparency throughout the outsourcing arrangement. Building strong relationships with outsourcing partners based on trust and mutual understanding is crucial for long-term success.

OBG outsourcing services in the UK offer a strategic solution for businesses looking to streamline operations, reduce costs, and enhance compliance. By leveraging the expertise of third-party providers, businesses can access specialized skills, improve efficiency, and focus on core activities essential for growth and success in today's competitive business environment.

However, successful outsourcing requires careful planning, diligent oversight, and a commitment to building strong partnerships based on trust and communication. With the right approach, outsourcing accounting services can unlock significant value and propel businesses towards sustainable growth and prosperity.

Ready To Discuss Your Accounting Challenges?

Read More About Latest Blogs

How CPA Firms Benefit from Professional Payroll Services

In today’s fast-paced financial landscape, CPA firms are expected to deliver more than just tax preparation and compliance. Clients now look for ...Read More

Why Every Business Needs a Reliable Bookkeeping Service

In today’s fast-paced business environment, success isn’t just about sales — it’s about smart financial management. Behind every thriving c...Read More

The Role of Management Reports in Business Decision-Making

In today’s data-driven economy, businesses are not short on information — they’re short on clarity. The difference between growth and stagnat...Read More

How Regular Reconciliations Prevent Financial Discrepancies

In today’s fast-paced digital economy, financial data moves in milliseconds—but mistakes move just as fast.

A duplicated payment.

A mi...Read More

Top Tax Planning Tips for the Upcoming Year

Tax planning isn’t something you do in March — it’s a year-round strategy. Businesses that proactively plan don’t just reduce tax liability...Read More

Beyond the Ledger: Why Payroll Outsourcing is the Ultimate Growth Hack

In the modern business landscape, "hustle culture" is being replaced by something much smarter: Essentialism. It’s the art of doing what you do b...Read More

Data is the New Oil, but Bookkeeping is the Refinery

In the modern business landscape, "gut feeling" is a relic of the past. For small businesses and startups in 2026, the difference between a unicorn...Read More

Beyond the Ledger: Modern Bookkeeping for the Real Estate Mogul

In the fast-paced world of real estate, the difference between a thriving portfolio and a financial headache often comes down to one thing: the boo...Read More

How OBG Outsourcing Inc. Handles Payroll Tax Filings

Payroll tax compliance is one of the most sensitive and time-critical responsibilities for any business. A single missed deadline or miscalculation...Read More

Using Management Reports to Drive Business Growth

Business growth rarely happens by accident. It is the result of informed decisions, consistent monitoring, and the ability to respond quickly to fi...Read More

Understanding Payroll Tax Liabilities: A Complete Guide for Business Owners

Payroll tax liabilities are among the most important financial responsibilities a business must manage. Whether you run a small startup or a growin...Read More

Key Differences Between Bookkeeping and Accounting for Entrepreneurs

For many entrepreneurs, financial management often begins as a simple task—tracking income, recording expenses, and ensuring bills are paid on ti...Read More

Why Smart Businesses Are Choosing Outsourced Accounting in 2026

In today’s fast-moving business environment, managing finances accurately is no longer just an operational task—it’s a strategic priority. Co...Read More

Benefits of Regular Financial Health Check-Ups for Your Business

Most business owners monitor sales and expenses, but very few conduct structured financial health check-ups. Just like routine medical check-ups pr...Read More

Why Offshoring Tax Prep Improves Profitability for CPA Firms

Tax season places enormous pressure on CPA firms. Tight deadlines, staffing shortages, rising payroll costs, and client expectations make profitabi...Read More

Top Tax Deductions Every Small Business Should Know for the 2025 Tax Season

As the 2025 tax season approaches, small business owners are looking for ways to legally reduce their tax burden and improve cash ...Read More

Why Monthly Bookkeeping Is Critical for Accurate Financial Reporting

Many business owners treat bookkeeping as a once-a-year task, usually right before tax filing. However, monthly bookkeeping is critical for accurat...Read More

How Bookkeeping Affects Your Business Taxes: What Every Business Owner Must Know

Many business owners think bookkeeping is just about recording transactions—but in reality, bookkeeping directly affects your business taxes. Poo...Read More

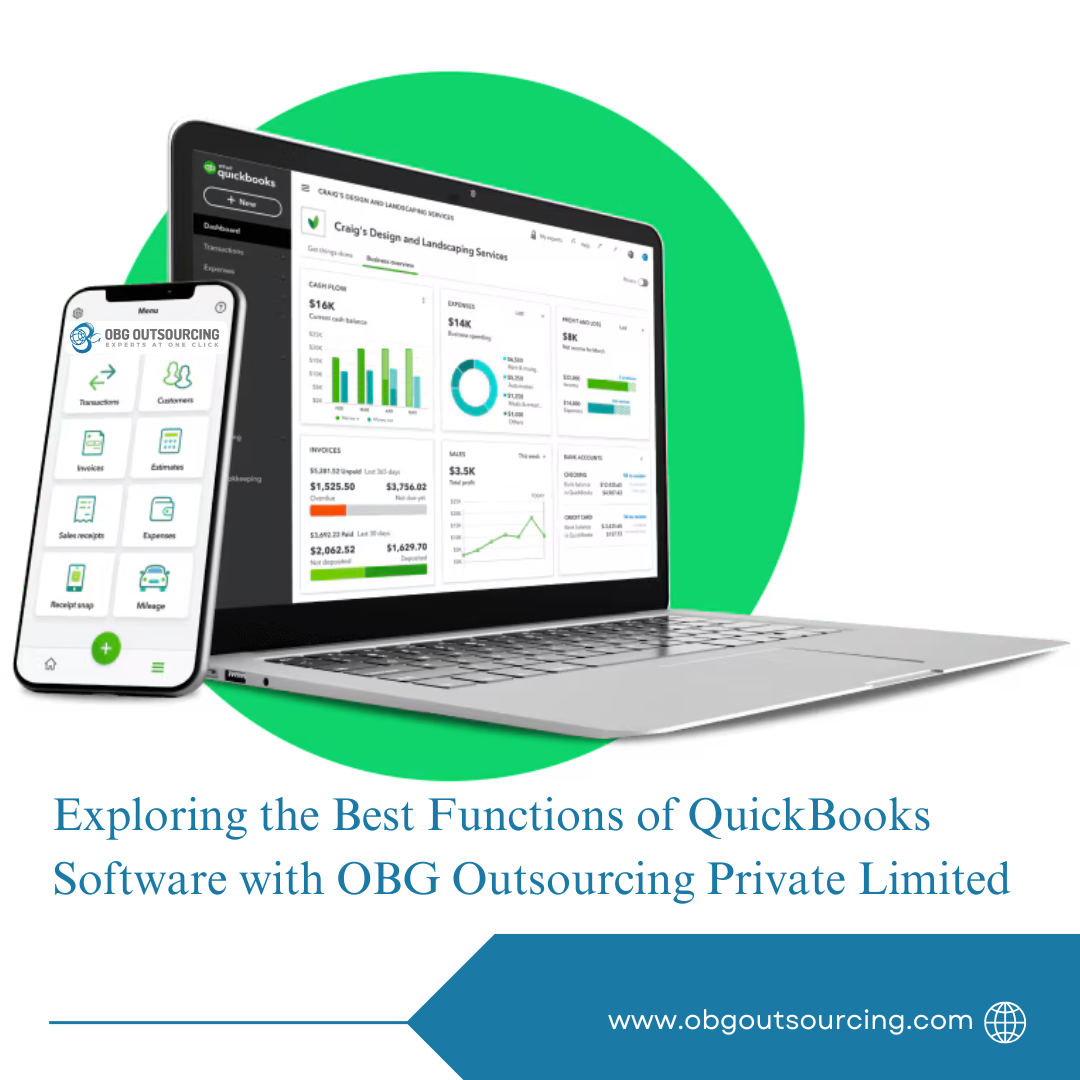

Quick Book Accounting Software: Why the QuickBooks Accounting Package Is Essential for Certified Public Accounting

In today’s digital-first business environment, reliable accounting systems are critical for accuracy, compliance, and growth. Quick Book accounti...Read More

Transforming Financial Success: How Strategic Outsourcing Elevates Business Growth

In today’s competitive business environment, sound financial processes aren’t just a back-office function — they’re a strategic driver of g...Read More

The Future of Finance: How Outsourced CFO Services Drive Business Growth

In today’s rapidly changing business environment, financial leadership isn’t just about bookkeeping and tax compliance — it’s about strateg...Read More

Why Smart Businesses Turn to Practical Financial Insights

In today’s competitive business environment, making decisions based on guesswork is no longer an option. Whether you’re a startup finding your ...Read More

Transform Your Business with Expert Outsourcing Solutions by OBG Outsourcing

In today’s fast-paced business world, staying ahead means focusing on what you do best — and leaving the rest to the experts. That’s where OB...Read More

Introduction to Wave Accounting Software With FAQ for Modern Business Requirements

Wave Accounting Software is a free cloud based accounting platform designed to help small businesses manage their finances without high software co...Read More

Affordable Sales Tax Accounting Solutions for Small Businesses: What to Look For and How to Choose

Sales tax compliance is one of the most challenging responsibilities for small businesses—especially as companies expand online or operate across...Read More

What Are the Best Five Basic Functions of QuickBooks?

QuickBooks is one of the most widely used accounting software solutions for small and medium-sized businesses. Many business owners ask a simple qu...Read More

Outsourcing Accounting and Tax Services to Indian Firms: A Practical Guide for CPA Firms

Outsourcing accounting and tax services to Indian firms has become a strategic solution for CPA firms facing rising costs, staffing shortages, and ...Read More

Online Platforms for Restaurant Tax and Accounting in the US: A Complete Guide

Managing finances in the restaurant industry is complex. From daily sales reconciliation and tip reporting to payroll taxes and multi-state sales t...Read More

Ecommerce Chart of Accounts: A Complete Guide for Online Businesses

An accurate ecommerce chart of accounts is the foundation of clean bookkeeping, reliable financial reporting, and tax compliance f...Read More

How Do I Track Expenses and Categorize Them in Online Accounting Tools? A Complete Guide

Many business owners ask, how do I track expenses and categorize them in online accounting tools correctly?

Expense tracking is...Read More

What Services Do Accounting Firms Provide? A Complete Guide for Businesses

Many business owners ask a simple but important question:

what services do accounting firms provide?

Accounting firms do ...Read More

Bookkeeping Review vs Audit: Why Every CPA Firm Needs Both to Improve Quality of Work

Many CPA firms struggle with the same recurring issues—last-minute cleanup, audit delays, reviewer rework, and client dissatisfaction. The root c...Read More

GAAP and Cash Basis Accounting: Key Differences, Use Cases, and What’s Right for Your Business

Choosing between GAAP and cash basis accounting is one of the most important financial decisions a business can make. The accounti...Read More

Why Outsourcing Your Accounting & Bookkeeping is the Smart Move for Modern Businesses

In today’s fast-paced business world, efficiency and accuracy aren’t just goals — they’re necessities. But as companies scale, keeping fina...Read More

How to Add a Transaction to Reconciliation in QuickBooks Online (Step-by-Step Guide)

One of the most common questions QuickBooks Online users ask is:

how to add a transaction to reconciliation in QuickBooks Online.

This iss...Read More

Cloud-Based Accounting System: The Smart Choice for Modern Businesses & CPA Firms

A cloud-based accounting system has transformed the way businesses and accounting firms manage financial data. Unlike traditional ...Read More

Cash Accounting Advantages: Why Small Businesses Prefer the Cash Basis Method

Choosing the right accounting method is one of the most important financial decisions for a business. For many startups, freelancers, and small bus...Read More

What Is Freight in Accounting? Meaning, Examples, and Proper Treatment

Understanding what is freight in accounting is essential for accurate bookkeeping, cost control, and financial reporting—especia...Read More

Finance and Accounting Business Process Outsourcing Service Providers A Complete Guide for Modern Businesses

Finance and accounting business process outsourcing service providers play a critical role in helping businesses streamline operations reduce costs...Read More

Pros and Cons of Outsourcing Accounting Services A Complete Guide for Businesses

Outsourcing accounting services has become a popular strategy for businesses of all sizes. From small startups to established CPA firms, many organ...Read More

Accounting and Tax Services for Small Businesses Reporting Income on Schedule C

Many small businesses in the United States report their income and expenses on Schedule C Profit or Loss From Business as part of ...Read More

Gym Accounting A Complete Guide for Fitness Centers and Gym Owners

Running a gym or fitness center is not just about memberships and training sessions. Behind the scenes, gym accounting plays a critical role in mai...Read More

Tax Software for Small CPA Firms Choosing the Right Tools for Accuracy and Growth

Selecting the right tax software for small CPA firms is critical for delivering accurate tax returns meeting deadlines and scaling services efficie...Read More

Outsourced Accounting & Bookkeeping Services: How OBG Outsourcing Helps Businesses Grow

In today’s highly competitive business landscape, managing finances efficiently is critical for long-term success. However, many companies — es...Read More

Payroll Reconciliation Checklist for CPAs and Businesses

Payroll reconciliation is one of the most critical yet overlooked accounting processes for businesses and CPA firms. Even small payroll errors can ...Read More

What Is Payroll Clearing Account and Why It Is Important in Accounting

Many businesses ask what is payroll clearing account when setting up payroll in accounting software. Payroll accounting involves multiple steps inc...Read More

Payroll Accountants Play a Vital Role in Preventing Costly Payroll Errors and Compliance Risks

Payroll accountants play a vital role in preventing financial errors regulatory penalties and employee dissatisfaction. Payroll is one of the most ...Read More

Finance and Accounting Business Process Outsourcing Service Providers A Strategic Advantage for Modern Businesses

As businesses expand and financial regulations become more complex managing finance and accounting internally is no longer efficient for many organ...Read More

Finance and Accounting Business Process Outsourcing Service Providers A Complete Guide for Growing Businesses

In todays competitive business environment companies must manage finances accurately while controlling costs and scaling operations. Many businesse...Read More

Property Management Bookkeeping Services A Complete Guide for Landlords and Property Managers

Introduction

Managing rental properties requires more than collecting rent and paying bills. Property managers and landlor...Read More

How to Choose the Best Accounting Software for Your Small Business

Small businesses often struggle with choosing the right accounting software. With so many options available selecting the wrong system can lead to ...Read More

How Automating Your Bookkeeping Can Transform Your Small Business

Automation is changing how small businesses manage their finances. Traditional bookkeeping methods rely heavily on manual entry which creates delay...Read More

Why Cash Flow Management Matters Most for Small Businesses

Many small businesses focus on sales growth but overlook the most important financial factor cash flow. While profit indicates long term success ca...Read More

How to Choose the Right Bookkeeping System for Your Small Business

Choosing the right bookkeeping system is one of the most important decisions a small business will make. A well structured bookkeeping system helps...Read More

Financial Forecasting for Small Businesses How Accurate Books Drive Better Decisions

Financial forecasting is one of the most powerful tools a small business can use to plan for growth manage cash flow and avoid financial surprises....Read More

Why Tax Planning Matters for Small Business Owners A Complete Beginner Guide

Tax planning is one of the most important financial responsibilities for small business owners yet many overlook it until tax season arrives. Prope...Read More

Business Budgeting for Beginners A Simple Guide for Small Business Owners

Many small business owners struggle with budgeting because they do not know where to start or they rely on guesswork instead of financial data. A c...Read More

Financial Forecasting for Small Businesses How to Plan for Growth with Confidence

Every successful business relies on financial forecasting to plan for growth manage risks and make informed decisions. For small businesses forecas...Read More

How to Reconcile Bank Accounts in QuickBooks Online A Complete Guide for Small Businesses

Bank reconciliation is one of the most important accounting tasks for any business. It ensures that the transactions in QuickBooks Online match the...Read More

Mastering Accounts Payable Best Practices for Small Businesses

Accounts payable is one of the most essential functions in business accounting. When handled correctly it improves cash flow strengthens vendor rel...Read More

Corporate Tax Filing in the UAE A Complete Guide for Businesses and How OBG Outsourcing Helps Ensure Compliance

The UAE corporate tax regime has introduced a new phase of compliance for businesses operating in the region. While the UAE historically did not le...Read More

Real Estate Accounting Services and Tax Solutions A Complete Guide for Property Investors and Developers

Real estate businesses operate in one of the most complex financial environments. Whether you manage rental properties, work as a real estate devel...Read More

How AI Is Transforming Accounting and Tax Services A Modern Guide for Businesses

Artificial intelligence has become one of the most important innovations in the accounting and tax industry. Businesses small and large as well as ...Read More

Cloud Accounting Benefits Why Modern Businesses Are Switching to Online Bookkeeping

The shift from traditional desktop accounting to cloud based bookkeeping has transformed how businesses manage their financial records. Today small...Read More

Understanding Accrual Accounting A Complete Guide for Small Businesses

Accrual accounting is one of the foundational methods used in modern financial reporting. While many small businesses begin with cash basis account...Read More

Chart of Accounts for SaaS Companies A Complete Guide for Accurate Financial Management

The financial structure of a SaaS company looks very different from traditional businesses. With monthly recurring revenue MRR deferred revenue sub...Read More

Impact of AI on Recordkeeping in E Commerce Businesses and How OBG Outsourcing Stays Ahead with Modern Technology

The rapid growth of e-commerce has completely transformed the way businesses manage orders, payments, customer data, and financial reporting. With ...Read More

Hospitality Accounting and Tax Solutions Expert Services for Hotels and Motels by OBG Outsourcing

Running a hotel, motel, or hospitality business requires more than offering excellent service to guests. Behind the scenes, financial accuracy is e...Read More

Pay Per Return Tax Software for Tax Professionals: A Complete Guide

In today’s competitive accounting landscape, flexibility and cost efficiency are key for tax professionals. Whether you’re a small CPA firm, an...Read More

How to Undo Reconciliation in QuickBooks Online: Step-by-Step Guide

Reconciliation is a critical step in bookkeeping—it ensures that your QuickBooks records match your bank and credit card statements. However, mis...Read More

How to Merge Credit Card Accounts in QuickBooks Online: A Step-by-Step Guide

Managing multiple credit card accounts in QuickBooks Online (QBO) can become confusing, especially when duplicate accounts are cre...Read More

How Do I Reprint a Bank Reconciliation in QuickBooks? A Complete Step-by-Step Guide

If you use QuickBooks Online or QuickBooks Desktop, you already know how important bank reconciliation is for accurate bookkeeping. But what happen...Read More

How to Use ChatGPT for Accounting: A Complete Guide for Modern Businesses

In today's digital era, artificial intelligence (AI) is transforming various industries, including accounting. Among the latest innovations, ChatGP...Read More

Management Accounting and Cost Accounting Difference Explained

Understanding the difference between management accounting and cost accounting is essential for businesses aiming to make informed...Read More

Advantages of Cash Basis Accounting A Simple Guide for Small Businesses

When it comes to managing business finances, one of the first decisions is choosing between cash basis accounting and accrual acco...Read More

Amazon Accounting Services Comprehensive Guide for Sellers

In the fast-paced world of e-commerce, Amazon accounting services are crucial for sellers to track sales, manage expenses, comply ...Read More

Real Estate Accounting Journal Entries A Complete Guide for Accurate Property Financial Management

Real estate accounting requires precision because every transaction—whether buying, leasing, or managing property—affects multiple accounts. Un...Read More

Is Cash Basis Accounting GAAP A Complete Explanation for Businesses

Business owners often ask, is cash basis accounting GAAP compliant The short answer is no. The cash basis method of accounting is not recognized un...Read More

New Accounting Client Checklist A Complete Guide for Accountants and Bookkeepers

When onboarding a new accounting client, organization and accuracy are key. A well-prepared new accounting client checklist ensures that accountant...Read More

How to Print a Bank Reconciliation in QuickBooks Online A Complete Guide

Bank reconciliation is one of the most important steps in maintaining accurate books in QuickBooks Online. It ensures that the balance in your Quic...Read More

Accounting for Advertising Agencies A Complete Guide for Creative Firms

Introduction

Advertising agencies focus on creativity and results for clients. However, if the financial side of the busin...Read More

What to Charge for Bookkeeping Services A Complete Pricing Guide for Bookkeepers and Small Businesses

If you are starting a bookkeeping business or planning to outsource bookkeeping, one of the most common questions is

what to charge for bookkeep...Read More

Three Accounting Issues Associated With Accounts Receivable Are What Every Business Should Know

Accounts receivable represents the money customers owe the business. While it looks like a simple balance on the financial statements, managing rec...Read More

Chart of Accounts for Law Firms

A complete guide for accurate bookkeeping and financial management

Running a law firm means more than winning cases. It also requires strong ...Read More

Beneficial Ownership Information (BOI) Filing: A Guide to Compliance and How OBG Outsourcing Private Limited Can Help

With the new regulations introduced by FinCEN regarding Beneficial Ownership Information (BOI), businesses in the U.S. are now required to comply w...Read More

Affordable Bookkeeper Starting at $50 per Month: Empower Your Small Business with OBG Outsourcing Private Limited

Running a small business comes with many challenges, and keeping your finances organized shouldn’t be one of them. At OBG Outsou...Read More

QuickBooks Cleanup Services: Why Your Business Needs It and Why OBG Outsourcing Is the Best Choice

Accurate and organized financial records are the foundation of every successful business. However, many companies — even those using QuickBooks O...Read More

Comprehensive Accounting and Bookkeeping Services for Auto Dealers in the USA

Running a successful auto dealership involves more than just selling cars — it requires diligent financial management, accurate bookkeeping, and ...Read More

How to Make a Bank Reconciliation: A Step-by-Step Guide by OBG Outsourcing Private Limited

Bank reconciliation is a vital part of maintaining accurate financial records for any business. It ensures that the balances in your accounting rec...Read More

Accounting for Digital Marketing: Expert Solutions to Boost Profitability and Compliance

The digital marketing industry moves fast and evolves constantly—making financial management and tax compliance a challenge for both agencies and...Read More

Easiest Accounting Software: Simplifying Financial Management for Small Businesses with OBG Outsourcing Private Limited

Choosing the easiest accounting software is essential for small businesses aiming to simplify financial management and boost productivity. With cou...Read More

A Bank Reconciliation Should Be Prepared: Why It's Critical for Your Business

In the world of business finance, maintaining accurate financial records isn’t just a good habit—it’s essential. One of the most important pr...Read More

Expert Reconciliation Services from OBG Outsourcing Private Limited

At OBG Outsourcing Private Limited, we understand that maintaining accurate financial records can be complex and time-consuming. That’s why we of...Read More

Best Payroll Services for Small Business: Streamline Your Payroll with OBG Outsourcing Private Limited

Running a small business involves juggling multiple responsibilities — and managing payroll can be one of the most challenging. From ensuring com...Read More

The Best Accounting Software for Farms: Streamline Your Agricultural Finances with OBG Outsourcing Private Limited

Managing a farm’s finances can be challenging. From tracking crop yields and livestock to calculating equipment depreciation and managing payroll...Read More

Maximize Efficiency with ProConnect Tax Online: Tax Return Preparation Services by OBG Outsourcing Private Limited

For businesses and individuals alike, filing accurate and timely tax returns is essential. At OBG Outsourcing Private Limited, we specialize in str...Read More

General Ledger Accounting Example: How OBG Outsourcing Private Limited Simplifies Your Business Accounting

For businesses of all sizes, maintaining an accurate general ledger is essential for financial health and compliance with accounting standards. At ...Read More

Comprehensive Accounting for Contractors: How OBG Outsourcing Private Limited Can Help Your Business Thrive

For contractors, managing finances can be complex and time-consuming. With fluctuating project costs, variable labor rates, and frequent material c...Read More

How AI Is Changing Accounting & Tax Services Today

The accounting and tax profession is undergoing a profound transformation driven by artificial intelligence (AI), machine learning (ML), and genera...Read More

Real Estate Accounting & Tax Services: What Real Estate Businesses Need and How OBG Outsourcing Delivers

The real estate industry has its own financial complexities—long-term projects, fluctuating costs, varied revenue models, and intricate tax rules...Read More

Understanding Accounting for Not-for-Profit Organizations: How OBG Outsourcing Private Limited Can Help

Managing accounting for not-for-profit organizations is unique compared to other sectors, requiring a strong focus on transparency, compliance, and...Read More

Chart of Accounts for the Construction Industry: Essential Guide for Efficient Financial Management

A well-structured chart of accounts is the backbone of accurate financial management in the construction industry. It helps business owners, accoun...Read More

Which QuickBooks Function Would Be Most Useful?

A Guide for Businesses by OBG Outsourcing Private Limited

As businesses expand and financial management becomes more compl...Read More

Ensuring Financial Integrity with Compliance Monitoring Services by OBG Outsourcing Private Limited

In today’s complex regulatory landscape, businesses are under constant scrutiny to comply with various financial and legal requirements. Whether ...Read More

Streamline Your Financials with OBG Outsourcing Private Limited’s Expert Accounting Review Services

Running a business is no small feat, and managing your finances can be particularly challenging. Accurate and reliable financial statements are cru...Read More

Optimizing Financial Success with Expert Budgeting and Forecasting Services from OBG Outsourcing Private Limited

In today's competitive business landscape, effective budgeting and forecasting are crucial for maintaining financial health and ensuring long-term ...Read More

FICA Tip Credit: Understanding the Benefit and How OBG Outsourcing Can Help Businesses Claim It

What Is FICA Tax?

Before understanding the FICA Tip Credit, it’s important to answer a common question: what is FICA tax?<...Read More

Expert Church Accounting and Tax Services: Ensuring Compliance and Stewardship with OBG Outsourcing Private Limited

Churches and religious organizations face unique financial challenges and responsibilities, particularly in accounting and tax compliance. With spe...Read More

Specialized Accounting Services for Digital Marketing Businesses | Streamlining Financial Success

In the fast-paced world of digital marketing, managing finances efficiently is just as crucial as executing a successful ad campaign. OBG Outsourci...Read More

What is Backlog in Accounting?

In accounting and business operations, backlog refers to the accumulation of work, orders, or transactions that have not yet been processed, comple...Read More

How Does QuickBooks Work? A Comprehensive Guide to Simplify Your Business Accounting

QuickBooks has revolutionized how businesses manage their finances. Designed for small and medium-sized businesses, this powerful accounting softwa...Read More

Why CPAs and Accounting Firms Need Offshore Support for Year-End Accounting & Tax Season Success

The Growing Challenge for CPAs & Accounting Firms

Every year, CPA firms and accounting professionals face the same cha...Read More

Understanding the Types of Taxes in the U.S.: A Comprehensive Guide

The U.S. tax system plays a vital role in funding government operations and public services at the federal, state, and local levels. For businesses...Read More

Accounting, Bookkeeping, and Tax Services for Gas Stations – Simplify Your Finances with OBG Outsourcing

Gas stations are more than just fuel stops — they are complex retail businesses that combine fuel sales, convenience stores, car...Read More

Service Business Chart of Accounts: A Complete Guide for Small Businesses and CPAs

Running a service-based business — whether you own a salon, fitness studio, digital marketing agency, consulting firm, or IT ser...Read More

Top 5 Benefits of Professional Bookkeeping for Small Businesses

For small business owners, maintaining accurate financial records is crucial for long-term success. Bookkeeping, though often overlooked, serves as...Read More

Accounting and Tax Services for Hotels and Hospitality Businesses

Running a hotel or hospitality business is exciting but financially complex. From daily cash flow tracking to multi-channel revenue reporting, payr...Read More

Preparing for Tax Season: Essential Tips for Small Businesses

Tax season can be stressful for small business owners, but with the right preparation and expert guidance, you can navigate it smoothly—and even ...Read More

What is the Double-Entry Bookkeeping System? A Guide for Business Owners

Running a business involves more than just selling products or services—it requires precise financial management to ensure long-term success. One...Read More

ProConnect Tax Return Preparer Services – Why CPAs and Accounting Firms Trust OBG Outsourcing

Understanding ProConnect Tax Software

ProConnect Tax is one of the most advanced tax preparation software solutions develo...Read More

Hired Offshore CPA: Why Businesses Choose Offshore Accounting with OBG Outsourcing

In today’s fast-changing business environment, hiring an offshore CPA has become one of the smartest strategies for businesses, ...Read More

Why Is Accounting Important? Understanding Its Role in Business Success

What Is an Accountant?

An accountant is a financial professional responsible for recording, analyzing, and reporting financial transactions...Read More

Sales Tax Compliance Made Simple: How OBG Outsourcing Helps Businesses Across States

Sales tax compliance in the United States is one of the most complex challenges small businesses, eCommerce sellers, and CPA firms face. Each state...Read More

Understanding Sole Proprietorship Taxation in the USA

What is a Sole Proprietorship?

A sole proprietorship is the simplest and most common form of business ownership in the Uni...Read More

What is Bank Reconciliation and Why is it Essential for Accounting?

What is Bank Reconciliation?

Bank reconciliation is the process of comparing a company’s financial records with its bank...Read More

Accountant for Coffee Shop – Why OBG Outsourcing is the Perfect Fit

Running a coffee shop isn’t just about brewing the perfect cup—it’s also about managing cash flow, tracking daily sales, handling payroll for...Read More

How to Count Income Tax: A Complete Guide

What is Income Tax?

Income tax is a mandatory tax imposed by the government on an individual’s or business’s earnings....Read More

Offshoring Accounting Services – Why Businesses Choose OBG Outsourcing

In today’s globalized economy, offshoring accounting services has become a strategic move for businesses and CPA firms seeking c...Read More

Bank Reconciliation Tips and Tricks: Ensuring Accuracy in Your Financial Records

What is Bank Reconciliation?

Bank reconciliation is the process of comparing your company's financial records with your bank statement to e...Read More

How Do I Invite My Accountant to QuickBooks Online?

Managing business finances can be time-consuming, which is why many small and medium businesses work with accountants or bookkeepers through

Accounting for Gyms and Fitness Centers: A Complete Guide

Running a gym or fitness center is more than offering memberships and classes—it requires strong financial management to ensure ...Read More

Accounting for FBA: A Complete Guide for Amazon Sellers

Selling through Amazon FBA (Fulfilled by Amazon) opens massive growth opportunities for eCommerce businesses. But managing FBA ope...Read More

Accounting for Automation: The Future of Finance with OBG Outsourcing

In today’s digital economy, accounting for automation has become more than a trend—it’s a necessity. From small businesses t...Read More

Bookkeeping for Healthcare Professionals: Why Accurate Financial Management Matters

Healthcare professionals—whether doctors, dentists, therapists, or clinic owners—spend most of their time caring for patients. However, behind ...Read More

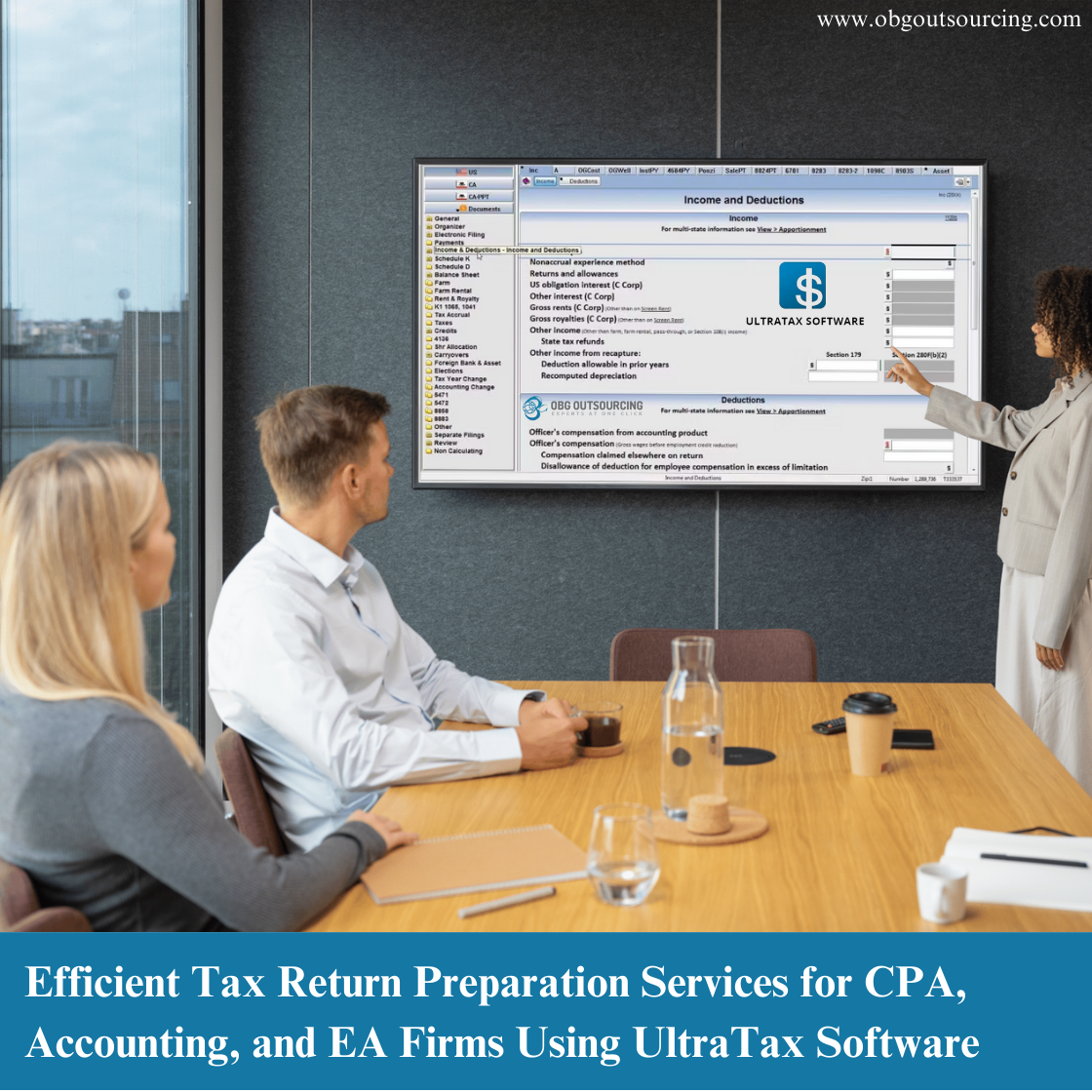

Drake Tax Return Preparation Services by OBG Outsourcing

Managing tax returns in today’s fast-paced accounting industry requires accuracy, efficiency, and compliance with the latest IRS regulations. For...Read More

New York Sales Tax Services: Rates, Rules & Deadlines – Your Compliance Partner OBG Outsourcing

As businesses expand across New York State, understanding sales tax services in New York<...Read More

Accounting and Tax Return Preparation Review Services for CPA Firms in the Age of AI

The accounting and tax industry is rapidly evolving. With the introduction of AI-powered bookkeeping and tax solutions, CPA firms,...Read More

Alabama Sales Tax: Nexus, Registration, Filing & How OBG Outsourcing Can Help

Alabama’s state and local sales tax system presents unique compliance challenges for businesses—whether you're in e-commerce, retail, or profes...Read More

Real Estate Fund Accounting Basics – A Guide for Investors and Fund Managers

Managing real estate investments requires more than just understanding property markets—it demands precise accounting. For investors, fund manage...Read More

Why CPA Firms Outsource Accounting and Sales Tax Services

The demand for accounting and bookkeeping services is growing as small and mid-sized businesses expect real-time reporting, compli...Read More

Corporate Tax Filing in the UAE – A Complete Guide for Businesses

The UAE corporate tax law has introduced a new era of taxation for businesses across the Emirates. With the first corporate tax filing deadline in ...Read More

A Complete Guide to Retail Accounting, QuickBooks Reconciliation, Bookkeeping Costs, and Small Business Tax Services

Managing business finances can be overwhelming without the right systems in place. From retail accounting to bank reconciliation in QuickBooks Onli...Read More

5 Importance of Accounting for Businesses

Accounting is often called the "language of business" because it provides vital financial insights that help business owners make smart, dat...Read More

Understanding and Accounting for Use Tax

What is Use Tax?

Use tax is a tax on the use, storage, or consumption of goods in a state where sales tax was not paid. It...Read More

Expert Bookkeeping Services for QuickBooks Online

Managing your business finances efficiently is crucial for success. QuickBooks Online offers a robust platform for handling various accounting task...Read More

Bookkeeping for Franchise Businesses in the USA: Why OBG Outsourcing Private Limited is the Best Choice

A franchise business is a thriving model in the USA, offering entrepreneurs the chance to run their own business while leveraging the brand power a...Read More

Accuracy in Accounting: Why It Matters and How to Get It Right

In the world of finance and business, accuracy is not just a goal — it is a necessity. When it comes to accounting, even a small error can lead t...Read More

Are Sole Proprietorships Taxed? How It Works and What You Need to Know

A sole proprietorship is the simplest way to start a business. But when it comes to taxes, many new business owners often ask: Are sole proprietors...Read More

10 Examples of Liabilities in Accounting Explained

In accounting, liabilities represent the financial obligations or debts a business owes to external parties. These arise from everyday operations a...Read More

Bookkeeping for Small Law Firms: Everything You Need to Know

Running a small law firm involves more than just representing clients and appearing in court—it also requires meticulous financial management. Bo...Read More

Corporate Tax Filing Services in the UAE with Accounting and Bookkeeping Support

With the introduction of Corporate Tax in the UAE, compliance has become a top priority for businesses of all sizes. Staying updat...Read More

Accounting Firms Key Services Offered

In today’s competitive business landscape, accounting firms play a vital role in supporting businesses of all sizes with accurate financial manag...Read More

Accountants for Plumbers: Simplified Bookkeeping for Your Plumbing Business

If you're a plumber, your day is packed with service calls, repairs, installations, and managing customer relationships. The last thing you want to...Read More

Accounting and Bookkeeping for Digital Marketing Agencies – A Complete Guide

Running a digital marketing agency means handling client projects, managing campaigns, and analyzing results. But what about your financial records...Read More

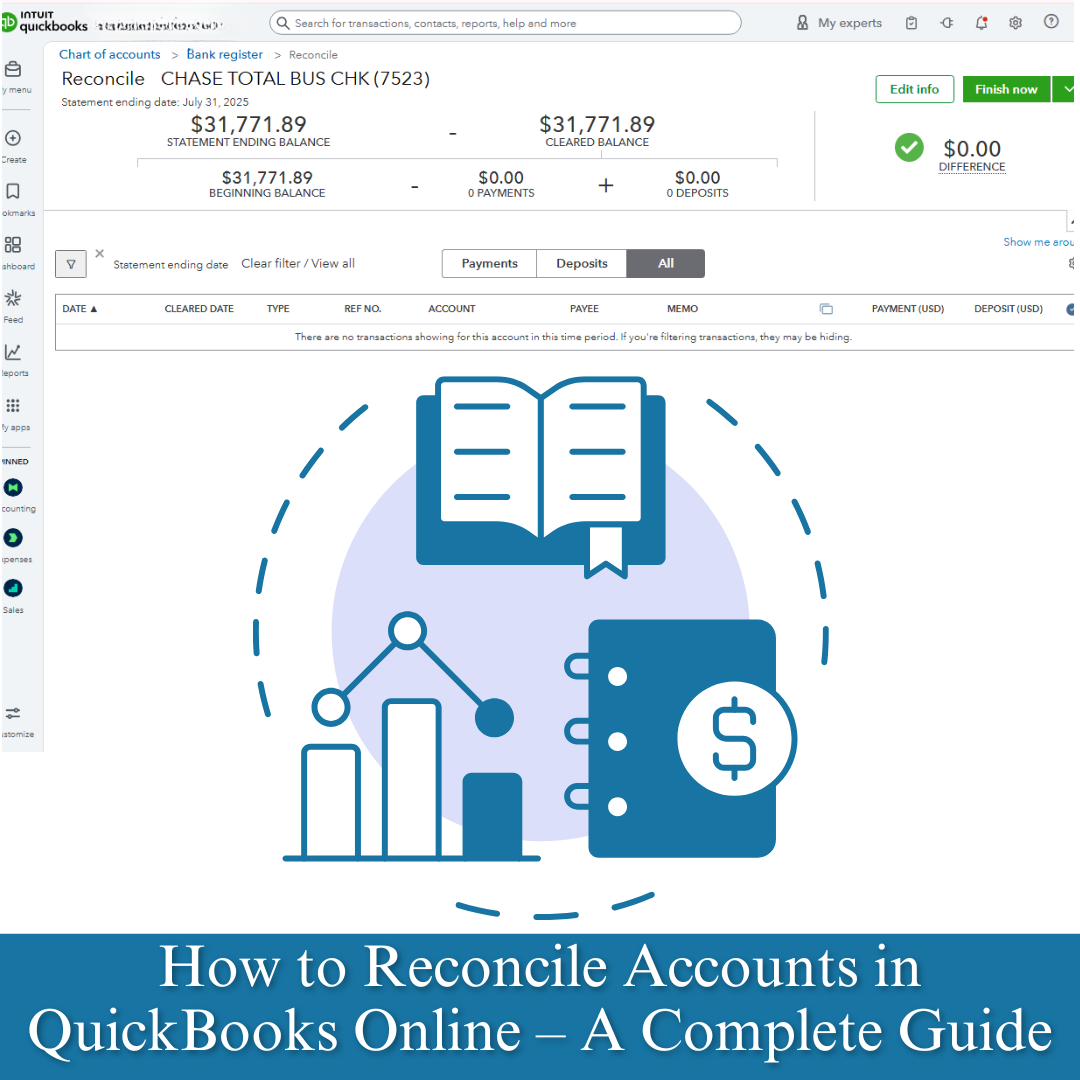

How to Reconcile Accounts in QuickBooks Online – A Complete Guide

Reconciling accounts is a crucial step in maintaining accurate financial records. In QuickBooks Online (QBO), reconciliation ensures that your bank...Read More

Accrual Accounting – A Complete Guide for Businesses

Accrual accounting is one of the most widely used accounting methods for businesses around the world. Unlike cash accounting, which records transac...Read More

Small Business Tax Accounting Services – Simplifying Taxes with OBG Outsourcing

Managing taxes is one of the biggest challenges for small business owners. From understanding complex tax laws to ensuring accurate filings, the pr...Read More

What is QuickBooks Used For? Bookkeeping, Payroll & More

QuickBooks is one of the most trusted accounting software solutions used by businesses worldwide. From tracking income and expense...Read More

Bank Reconciliation Services A Critical Step to Accurate Financial Management

Inaccurate financial records can hurt your business more than you think. When expenses are misclassified or transactions are missed, it leads to po...Read More

Reliable Accounting and Tax Preparation Services: Why OBG Outsourcing is the Right Partner for Your Business

In today's fast-paced business environment, reliable accounting and tax preparation services are not just a convenience—they are a necessity. Whe...Read More

Bookkeeping Strategies That Can Transform Your Business

Bookkeeping is more than just recording transactions—it’s the financial backbone of every successful business. It provides the clarity you need...Read More

Tax Compliance and Bookkeeping Services for Application and Web-Based Software Development Companies

Running a software development company in the United States—whether focused on web applications, SaaS products, or mobile solutions—requires me...Read More

Bookkeeping and Accounting Services for Equipment Leasing Companies

In the world of equipment leasing, maintaining accurate financial records is crucial for ensuring profitability, compliance, and operational effici...Read More

7 Differences Between Bookkeeping and Accounting – Why OBG Outsourcing Is the Right Choice

As a business owner, you’ve probably heard the terms bookkeeping and accounting used interchangeably. While both are crucial for financial manage...Read More

Bank Reconciliation Tips and Tricks – A Guide to Accuracy in Bookkeeping

Bank reconciliation is one of the most essential accounting tasks for maintaining accurate financial records. Whether you are a small business owne...Read More

Accounting, Bookkeeping, and Tax Services for Painters and Contractors

Running a successful painting or contracting business requires more than delivering high-quality work — it demands efficient financial management...Read More

Bookkeeping and Accounting Services for Influencers and YouTubers

In today’s digital economy, influencers and YouTubers aren’t just creators—they’re entrepreneurs. With multiple income streams like sponsor...Read More

Cash Flow Statement Example and How OBG Outsourcing Private Limited Can Help You Use It Right

Managing cash is one of the most critical aspects of running a successful business. Whether you are a freelancer, small business owner, or managing...Read More

Mileage Tracker Apps: Why They Matter and How OBG Outsourcing Pvt Ltd Can Help

Tracking mileage is one of the most overlooked areas of business finance, especially for freelancers, contractors, and small business owners who fr...Read More

Top 5 Bookkeeping Mistakes Small Businesses Make and How to Avoid Them

Bookkeeping is one of the most essential parts of running a successful small business. When done right, it helps you understand your cash flow, mak...Read More

Accounting and Tax Services for Salon Businesses That Help You Grow

Running a salon is about more than just offering great haircuts or beauty treatments. Behind the scenes, salon owners juggle cash flow, inventory, ...Read More

Beyond the Vines: Accounting and Tax Strategies for Wineries and Vineyards

Owning and managing a winery or vineyard is more than growing grapes and producing quality wine. It involves managing a complex business that spans...Read More

Monthly vs Annual Bookkeeping – Which One Do You Need?

Bookkeeping is the foundation of sound financial management. But when it comes to frequency, business owners often ask: Should I manage my books mo...Read More

Bookkeeping for Attorneys – What You Need to Know

Running a law firm comes with high-stakes responsibilities—managing clients, meeting court deadlines, and complying with strict ethical standards...Read More

A Beginner’s Guide to Setting Up Accounting for a New Business

Starting a business is exciting — but managing your finances correctly from day one is essential for long-term success. Without proper accounting...Read More

Why Cloud Accounting Is Essential in 2025

Why Cloud Accounting Is Essential in 2025

In today’s fast-paced digital world, traditional desktop accounting is quickly beco...Read More

Accounting and Tax Services for IT Hardware Sellers (Wholesale and Retail)

The IT hardware industry is fast-paced and highly competitive. Whether you’re a wholesaler or retailer, managing your finances effectively is ess...Read More

Why Accuracy and Precision Matter in Accounting Services

Accuracy and Precision in Accounting Services

In the world of accounting, two terms define the quality of financial work �...Read More

How Data Analytics Is Transforming the Future of Accounting

Accounting is no longer just about recording income and expenses—it's evolving into a data-driven powerhouse that helps business owners make smar...Read More

Understanding Debit vs Credit in Accounting

In double-entry bookkeeping, every financial transaction impacts at least two accounts — one is debited, and the other is credited. This approach...Read More

Balance Sheet vs Cash Flow Statement | OBG Outsourcing Financial Insights

Balance Sheet vs Cash Flow Statement: What Every Business Owner Should Know

Every successful business relies on three core financial statemen...Read More

Retail Business Accounting: A Complete Guide for Store Owners

Retail is a fast-moving and competitive industry. Success requires more than just selling products—you need accurate financial tracking, efficien...Read More

What Services Do Accounting Firms Offer? A Complete Breakdown

Many small business owners think accounting is only about filing taxes. But modern accounting firms offer a wide range of financial services that g...Read More

Accounting Services for Nail Technicians and Nail Spas: Streamlining Your Financial Management

As a nail technician or nail spa owner, your focus is on providing excellent services to your clients, whether it’s manicures, pedicures, or othe...Read More

Top 10 Benefits of Cloud-Based Bookkeeping for Modern Businesses

In today’s fast-paced business landscape, efficiency and real-time insights are crucial for growth. Traditional desktop accounting software and p...Read More

Automated Tax Services: The Future of Hassle-Free Tax Compliance for Businesses

In today's fast-paced digital world, automated tax services are revolutionizing how businesses manage their tax compliance. From r...Read More

What Does It Mean to Reconcile a Bank Account in QuickBooks Online?

One of the most important steps in maintaining accurate books is making sure your recorded transactions match what actually happened in your bank a...Read More

Complete Guide to Etsy Seller Accounting, Bookkeeping, and Tax Compliance Services

For Etsy sellers navigating the complexities of taxes, bookkeeping, and income estimation, having the right accounting support is essential. Whethe...Read More

True-Up in Accounting: Meaning, Synonyms, and Its Role in Accounting and Tax Services

In the world of accounting, accuracy is everything. Financial reports, tax filings, payroll summaries, and cash flow statements all need to reflect...Read More

Meaning of Liabilities in Accounting with Examples

Understanding financial terms is essential for any business owner, and one of the key concepts is liabilities. Whether you are rev...Read More

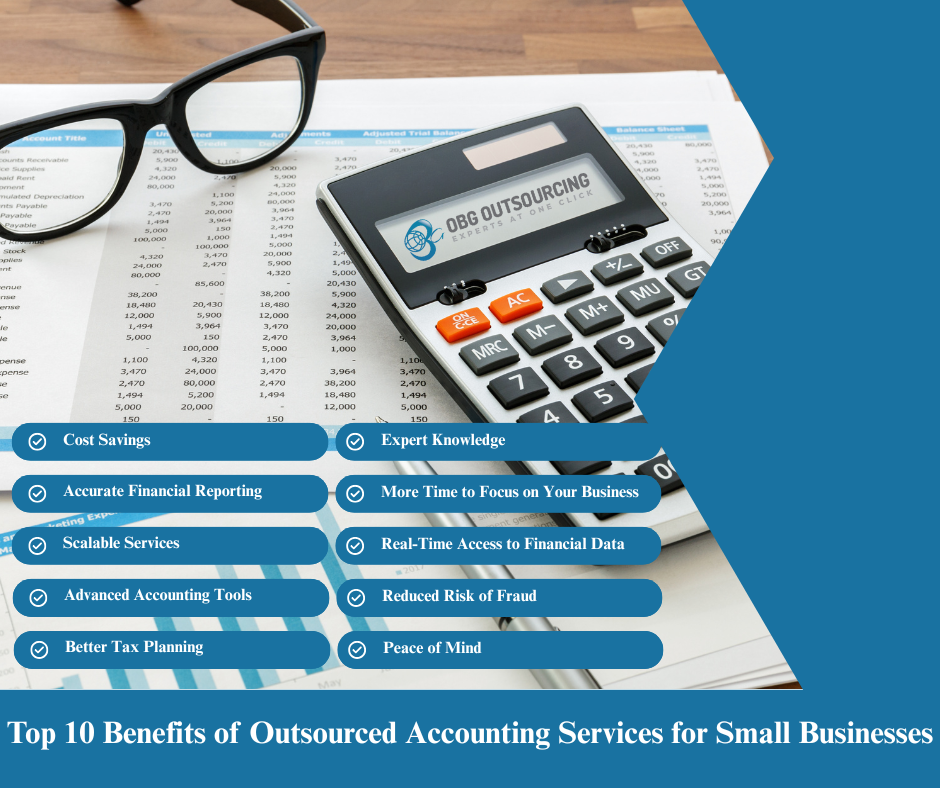

Top 10 Benefits of Outsourced Accounting Services for Small Businesses

Managing your company’s finances is essential, but it can also be time-consuming and complex. For small businesses and startups, hiring a full-ti...Read More

USA Tax and Accounting Services for Businesses and Individuals

Managing taxes and financial records in the United States can be a challenging task for both individuals and businesses. Whether you are a small bu...Read More

Rental Car Companies Accounting and Tax Services

Running a rental car company involves managing a wide range of financial operations. From fleet management and maintenance costs to customer deposi...Read More

QuickBooks Cleanup Services Why Your Business Needs a Bookkeeping Reset

If your QuickBooks file feels messy disorganized or outdated you are not alone. Many small and medium businesses fall behind on their bookkeeping d...Read More

QuickBooks Bookkeeping Services Everything Small Businesses Need to Know

Bookkeeping is the foundation of every successful business. For small businesses, freelancers, and growing startups, QuickBooks bo...Read More

Accounts Payable in Accounting A Complete Guide

Accounts payable is one of the most important components of business accounting. Whether you run a small business or a large enterprise, managing y...Read More

Starting and Growing a Bookkeeping Business in Canada

Bookkeeping is one of the most in-demand services for small and medium sized businesses across Canada. With growing awareness of financial complian...Read More

Sales Tax Compliance for Multi State eCommerce Businesses A Guide for Amazon Shopify and Walmart Sellers

As an ecommerce seller operating across multiple states and platforms like Amazon Shopify and Walmart understanding and managing sales tax complian...Read More

How to Do Sales Reconciliation Between Amazon Seller Central and Accounting Software

For Amazon sellers, keeping your books accurate is crucial for understanding profitability, managing cash flow, and staying compliant with tax laws...Read More

Accounting and Tax Services for Electronic Retail Businesses

Electronic retail businesses operate in a highly competitive and fast-moving environment. Whether selling smartphones, laptops, home appliances, or...Read More

Accounting and Bookkeeping Services with Tax Support for Coffee Shops

Running a successful coffee shop is about more than just great coffee and customer service. Behind the scenes, managing your finances properly is e...Read More

Top 7 Benefits of Outsourcing Bookkeeping Services to India

Bookkeeping is the backbone of every successful business. However, managing books in-house can be time-consuming, expensive, and error-prone—espe...Read More

Outsource Accounts Payable Services for Real Estate – Why It Matters

Managing accounts payable in the real estate industry is no small task. With multiple vendors, ongoing property maintenance, project contractors, a...Read More

What is Offshore Accounting and How to Choose the Best Offshore Accounting Firm

In today's competitive business world, companies are seeking new ways to cut costs, improve efficiency, and maintain compliance. One of the most pr...Read More

Travel Accounting – Simplifying Financial Management for Travel and Tourism Businesses

The travel and tourism industry is known for its dynamic and fast-paced nature. From managing bookings and customer payments to handling vendor rel...Read More

Best Accounting Automation System for Efficiency – A Complete Guide

In today’s fast-paced business environment, staying efficient and accurate in accounting is more important than ever. Traditional manual accounti...Read More

Accrued Revenue is Also Known as Accrued Income – Full Guide

In accounting, accrued revenue is a concept that ensures financial reports accurately reflect income earned during a period, even if the payment ha...Read More

Best Accounting Service Provider – Why OBG Outsourcing is the Right Choice

In today’s fast-paced and compliance-driven business world, managing finances effectively is not just a necessity—it’s a strategic advantage....Read More

Bookkeeping and Accounting Services with Tax Compliance for AI Startups

The rise of artificial intelligence (AI) businesses has brought forth unique financial management and tax compliance challenges. W...Read More

Why Outsourcing Accounting to India CPA Firms is the Smartest Move for Your Business

In today's competitive business environment, companies across the globe are turning to accounting outsourcing to reduce costs, inc...Read More

Bookkeeping with Xero A Complete Guide for Modern Businesses

Bookkeeping with Xero is changing the way businesses handle their finances. Whether you are a startup or an established business, Xero offers a sim...Read More

Accounting and Bookkeeping for Commercial Real Estate: A Complete Guide

When it comes to managing finances in the real estate industry, commercial real estate accounting presents unique challenges that ...Read More

Efficient Bookkeeping for Hotels: Essential Services, Software, and Solutions

Bookkeeping for Hotels: A Strategic Financial Approach

Bookkeeping for hotels is a critical financial process that tracks ...Read More

Bookkeeping Outsourcing Agency: A Game-Changer for Small Businesses

In today's fast-paced business environment, managing finances efficiently is crucial for success. A bookkeeping outsourcing agency...Read More

Comprehensive Guide to Accounting and Outsourcing Services for Small Businesses

Introduction to Accounting Outsourcing Services

In the modern business environment, managing finances efficiently is essential for success. H...Read More

Understanding Cost Basis vs. Tax Basis: A Comprehensive Guide?

What Is Cost Basis?

Cost basis refers to the original value or purchase price of an asset, including asso...Read More

Accrued Revenues: Definition, Calculation, Benefits, and Challenges?

What is Accrued Revenue?

Accrued revenue refers to income that a company has earned by delivering goods o...Read More

Accounting Outsourcing Services in the UK – A Smart Solution for Businesses

What is Accounting Outsourcing?

Accounting outsourcing involves contracting external accounting firms or ...Read More

Understanding the Cash Method of Accounting and How OBG Outsourcing Can Assist

What is the Cash Method of Accounting?

The cash method of accounting is a simple and widely used accounti...Read More

Bookkeeping for Real Estate Agents: Tailored Solutions for Financial Success?

What Is Bookkeeping for Real Estate Agents?

Bookkeeping for real estate agents involves systematically recording and manag...Read More

Bookkeeping Review: Ensuring Accuracy and Efficiency for CPA Firms and Small Businesses

Effective bookkeeping is a crucial component of managing any business, ensuring that financial records are accurate, organized, and compliant with ...Read More

Bookkeeping Services for SMEs: A Key to Financial Success

Running a small or medium-sized enterprise (SME) comes with its own set of challenges. One of the most critical aspects of business management is e...Read More

Mastering Accounting & Bookkeeping for Amazon FBA Sellers?

In the dynamic world of e-commerce, Amazon FBA (Fulfillment by Amazon) offers sellers unparalleled opportunities. However, the complexities of mana...Read More

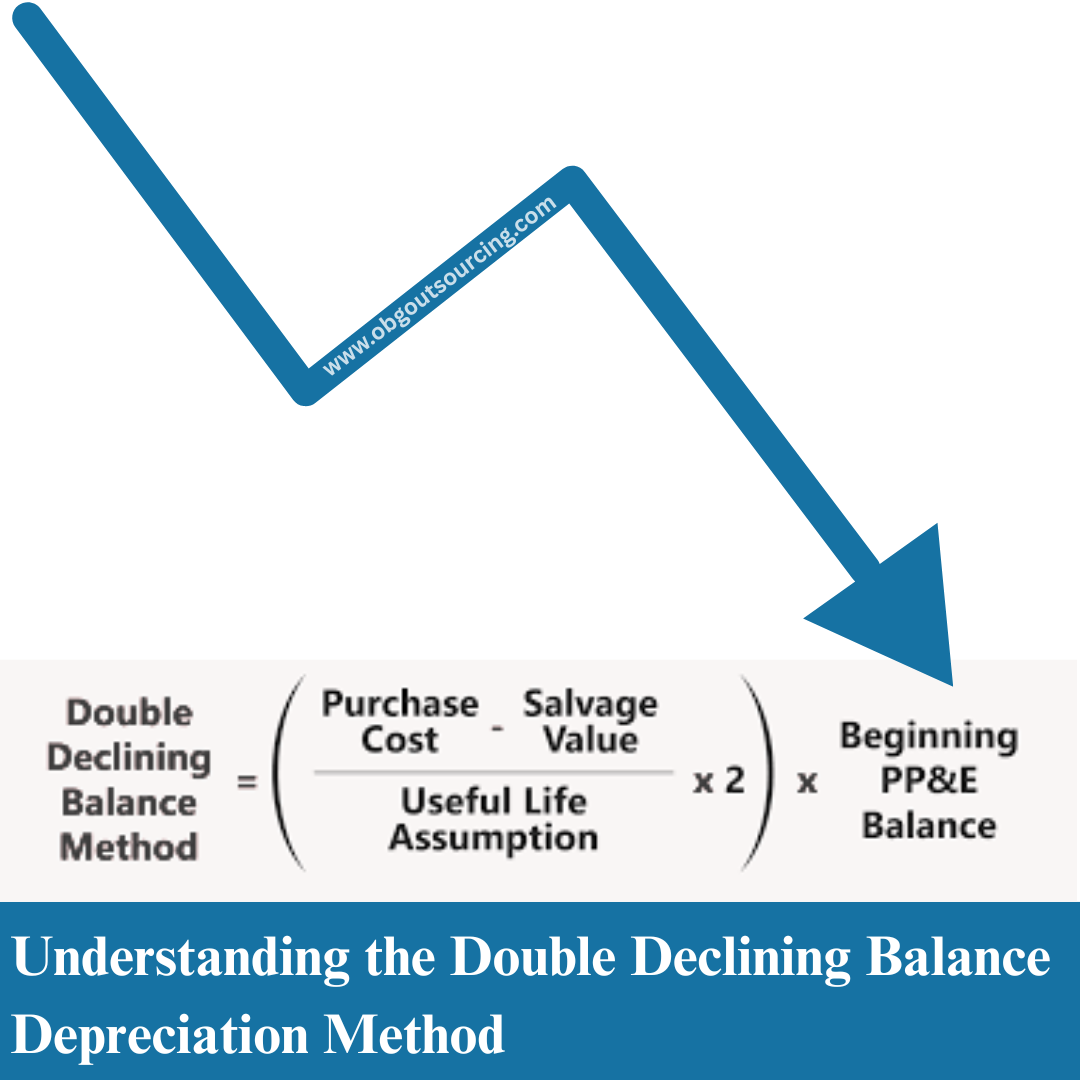

Understanding the Double Declining Balance Depreciation Method

Depreciation is a fundamental accounting concept that allocates the cost of tangible assets over their useful lives. Among various depreciation met...Read More

BillQuick Online Software: Simplifying Time Tracking and Billing for Your Business

In today's fast-paced business environment, accurate time tracking and efficient billing processes are crucial for maintaining profitability and op...Read More

Accounting and Bookkeeping for Floral Shops: A Comprehensive Guide

Floral shops, like any small business, face unique financial challenges that require proper management. Whether it's handling perishable inventory,...Read More

Affordable Bookkeeper: How to Find a Quality, Experienced Bookkeeper at the Right Price

When it comes to running a successful business, maintaining accurate financial records is crucial. However, many small businesses and startups ofte...Read More

How to Get Net Income: A Comprehensive Guide for Businesses

What is Net Income?

Net income is the final measure of a company’s profitability, reflecting the total earnings after deducting all expen...Read More

Understanding Cost Basis: Definition, Importance, and Common Issues

What is Cost Basis?

Cost basis is the original value or purchase price of an asset, such as stocks, bonds, mutual funds, or real estate. It...Read More

Understanding the Chart of Accounts A Guide to Structuring Your Business Finances

What is a Chart of Accounts

A Chart of Accounts COA is a structured list of all financial accounts used by a business to track transactions...Read More

Grocery Store Accounting: A Guide for Efficient Financial Management

Operating a grocery store involves handling various transactions, managing inventory, and keeping track of expenses and revenues. For grocery store...Read More

Understanding QBO Features, Benefits, and Why OBG Outsourcing is the Best Choice

What is QBO?

QuickBooks Online, widely known as QBO, is a cloud-based accounting software designed to hel...Read More

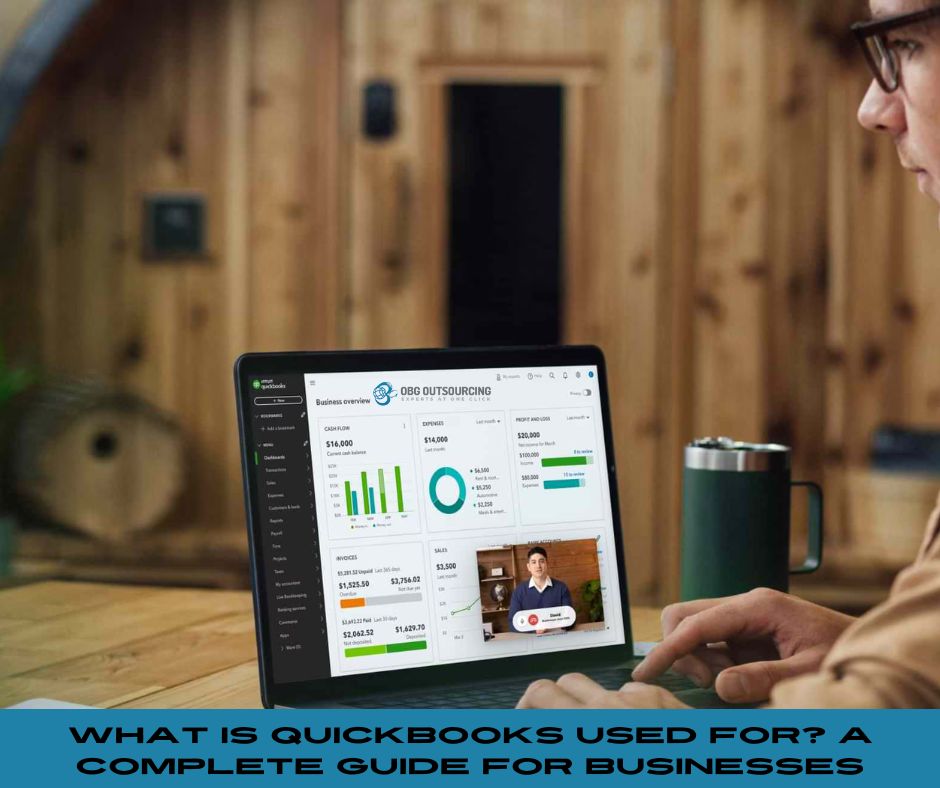

What is QuickBooks Used For? A Complete Guide for Businesses

Introduction to QuickBooks or QuickBooks definition or What is QuickBooks

QuickBooks is one of the most widely used accoun...Read More

Bookkeeping Costs for Small Businesses: How to Manage Expenses While Ensuring Quality Services

What is Bookkeeping Cost?

Bookkeeping cost refers to the e...Read More

Offshore Bookkeeping: A Comprehensive Guide for Accounting Firms and Small Businesses

What is Offshore Bookkeeping?

Offshore bookkeeping refers to outsourcing the management of a business’s...Read More

Understanding Accounts Payable: Efficient Management and Cost-Effective Solutions with OBG Outsourcing

What is Accounts Payable?

Accounts payable (AP) refers to the short-term liabilities a business owes to its suppliers or v...Read More

Finding the Best Accounting and Bookkeeping Services Provider in Ontario

Managing finances is a critical aspect of running a successful business. Whether you operate a small startup, a growing enterprise, or a well-estab...Read More

Bookkeeping Outsourcing Services in the UK: A Smart Solution for Businesses

What Are Bookkeeping Outsourcing Services in the UK?

Bookkeeping outsourcing services in the UK involve hiring external pro...Read More

Understanding Bookkeeping Review: What It Is and How OBG Outsourcing Can Help

In the world of accounting, accuracy is everything. Whether you are a small business owner or a larger enterprise, maintaining correct financial re...Read More

Understanding Sales Clearing Accounts for E-commerce and Businesses with Merchant Fees

For businesses, especially those in the e-commerce industry, managing sales transactions efficiently is crucial. With multiple payment gateways, me...Read More

The Essential Guide to Bookkeeping: What It Is, How to Do It, and Why OBG Outsourcing is Your Best Choice

Bookkeeping is one of the most critical components of running a successful business. It involves recording, organizing, and managing financial tran...Read More

Best Outsourced Bookkeeping Company for CPA Firms: How OBG Outsourcing Can Help

In the fast-paced world of accounting, CPA firms often find themselves handling numerous clients, staying on top of complex financ...Read More

Financial Outsourcing for Small Businesses: A Game-Changer for Growth and Efficiency

What is Financial Outsourcing?

Financial outsourcing refers to the practice of delegating financial management tasks—suc...Read More

Finding the Right Accounting Services Provider: A Complete Guide

What is an Accounting Services Provider?

An accounting services provider is a firm or professional that o...Read More

Understanding Accounting & Bookkeeping Costs: How to Optimize Expenses with OBG Outsourcing

What is Accounting & Bookkeeping Cost?

Accounting and bookkeeping costs refer to the expenses incurred by a business t...Read More

Canada Outsourcing Payroll: A Smart Solution for Businesses

Managing payroll is a critical function for businesses, but it can be time-consuming, complex, and prone to errors. For businesses in Canada,

Can AI Do Bookkeeping? Exploring the Future of AI-Powered Bookkeeping Solutions

In the rapidly evolving world of accounting and finance, Artificial Intelligence (AI) is revolutionizing bookkeeping by automating...Read More

Understanding Bank Clearing Accounts: Importance, Common Mistakes, and How to Set Up Properly

What is a Bank Clearing Account and Cash Clearing Account?

A bank clearing account or cash clearing account is a temporary...Read More

How OBG Outsourcing Can Assist in Customer and Vendor Reconciliation?

OBG Outsourcing provides expert customer and vendor reconciliation services, ensuring accuracy, efficiency, and compliance in fina...Read More

E-Commerce Tax: Understanding Global Taxation and Compliance Challenges

What is E-Commerce Tax?

E-commerce tax refers to the taxation of online sales and transactions, which includes sales tax, ...Read More

Expert Bookkeeping and VAT Services in Dubai: A Complete Guide

What are Expert Bookkeeping and VAT Services in Dubai?

Expert bookkeeping and VAT services in Dubai refer...Read More

Understanding the Chart of Accounts for a Business Firm: A Comprehensive Guide

What is a Chart of Accounts for a Business Firm?

A Chart of Accounts (COA) is a structured list of all fi...Read More

The Importance of Bookkeeping: A Guide to Efficient Financial Management

What is Bookkeeping?

Bookkeeping is the systematic process of recording, organizing, and managing a business’s financial...Read More

Shopify Reconciliation for eCommerce: Ensuring Accuracy in Financial Records

What is Shopify Reconciliation?

Shopify reconciliation is the process of matching and verifying sales, refunds, fees, and ...Read More

Accounting in Logistics: A Comprehensive Guide for Businesses

What is Accounting in Logistics?

Accounting in logistics refers to the financial management of transportation, warehousing...Read More

Accounting Outsourcing in Dubai, UAE: A Complete Guide for Businesses

What is Accounting Outsourcing in Dubai, UAE?

Accounting outsourcing in Dubai, UAE, refers to the practice of hiring exter...Read More

Australia GST Compliance for E-commerce Businesses: A Complete Guide

The e-commerce industry in Australia is growing rapidly, and businesses selling goods and services online must comply with Goods and Services Tax (...Read More

Medical Bookkeeper: The Key to Efficient Financial Management in Healthcare

Managing finances in the healthcare industry is different from standard business accounting. Medical bookkeeping requires speciali...Read More

Understanding Nexus Sales Tax: A Guide for Businesses

What is Sales Tax Nexus?

Sales tax nexus refers to a business's legal obligation to collect and remit sales tax in a state...Read More

Understanding Cash Basis of Accounting: A Simple Guide for Businesses

What is Cash Basis of Accounting?

Cash basis of accounting is a straightforward method where income is recorded when cash ...Read More

Accounts Payable vs. Accounts Receivable: Understanding Their Role in Business Accounting

What is Accounts Payable vs. Accounts Receivable?

Accounts payable (AP) and accounts receivable (AR) are two essential com...Read More

Efficient Bookkeeping Services: Why It Matters and How OBG Outsourcing Can Help

What is Bookkeeping?

Bookkeeping is the process of systematically recording, organizing, and managing financial transactio...Read More

How to Find Net Income: A Complete Guide for Businesses

What is Net Income?

Net income is a key financial metric that represents the total earnings of a business after deducting ...Read More

Build Your Offshore Accountants Team: A Smart Strategy for Business Growth

What is an Offshore Accountants Team?

An offshore accountants team is a group of accounting professionals located outside ...Read More

Understanding the IRS Mileage Rate for 2024: Maximizing Your Tax Deductions

As a business owner or self-employed individual, it's essential to stay informed about the IRS standard mileage rates to ensure you're maximizing y...Read More

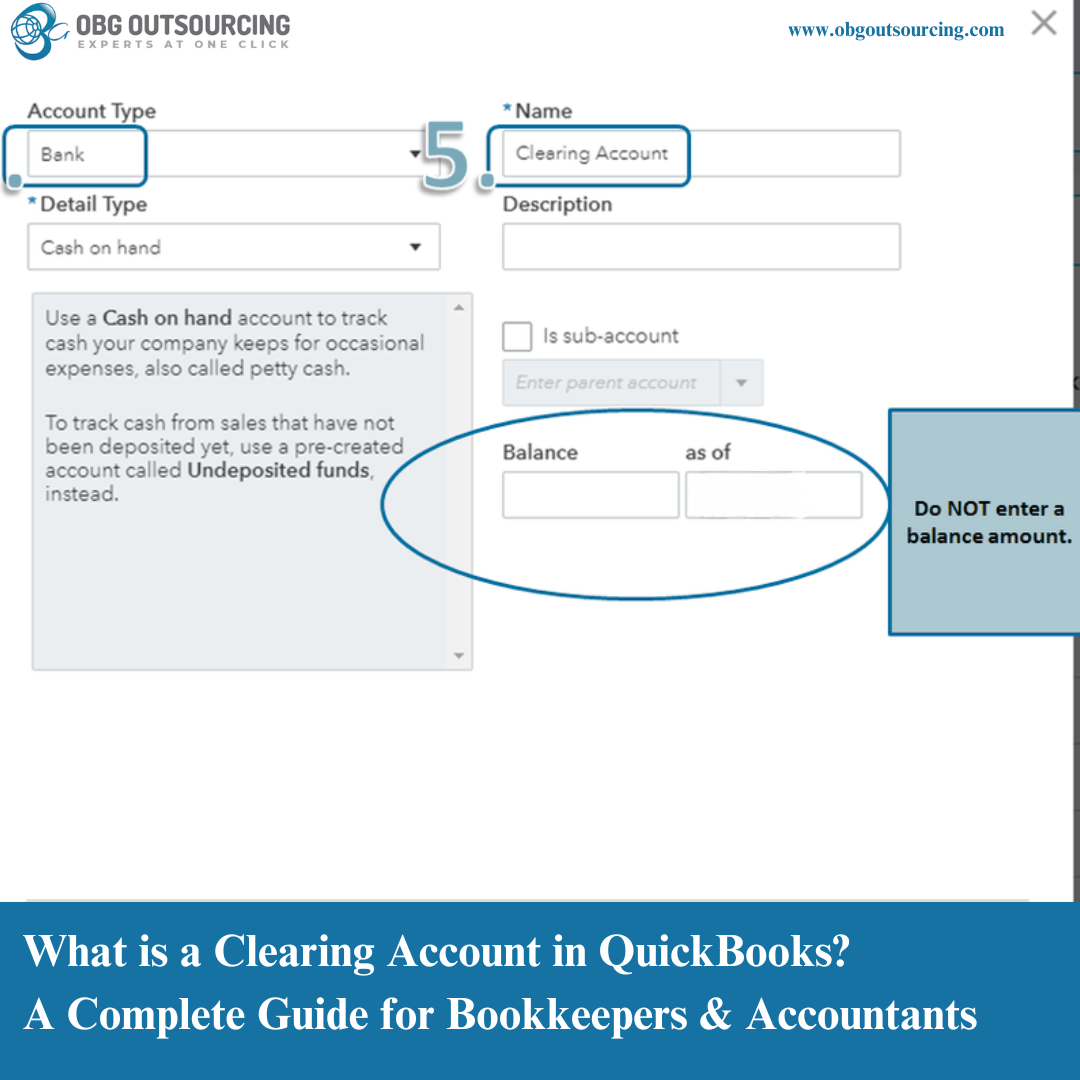

What is a Clearing Account in QuickBooks? A Complete Guide for Bookkeepers & Accountants

If you are a bookkeeper or accountant using QuickBooks, understanding the role of a clearing account is essential. Many users are unsure of what is...Read More

Offshore Bookkeeping Services: A Smart Solution for Small Businesses and Accounting Firms

In today's competitive business environment, financial accuracy and efficiency are crucial. Offshore bookkeeping services have eme...Read More

Convert Accrual to Cash Basis Worksheet: A Complete Guide for Businesses

Converting from accrual to cash or from cash to accrual in QuickBooks Online can be tricky without the right guidance. This guide walks you through...Read More

Streamlining Small Business Finances with Outsourced Accounting Services

Managing financial records is a critical aspect of running a small business, but it can often become overwhelming. Outsourcing accounting services ...Read More

Income Approach to Business Valuation: A Comprehensive Guide

What is the Income Approach to Business Valuation and Why is it Required?

The income approach to business valuation is a m...Read More

Accounting for Real Estate Developers: A Guide to Financial Success

The real estate industry operates in a complex, high-stakes environment where accurate financial management is essential for long-term success. Rea...Read More

Outsource Tax Return Preparation Services: A Smart Solution for Accounting Firms & CPAs

Tax season can be overwhelming for accounting firms, CPAs, and tax professionals handling multiple clients while ensuring complian...Read More

The Best Virtual Bookkeeping Services to Transform Your Business Finances

In today’s fast-paced business world, managing finances efficiently is more important than ever. However, for many business owners, bookkeeping c...Read More

Maximize Business Efficiency with Expert QuickBooks Accounting Services

Managing business finances can be complex and time-consuming, especially for small and medium-sized enterprises. From bookkeeping and tax preparati...Read More

Understanding Accrued Expenses and Their Importance for Small Businesses During Year-End Closing

As small businesses prepare for year-end closing, ensuring that all financial transactions are accurately recorded is crucial for maintaining a cle...Read More

The Importance of Reliable Bookkeeping for Small Businesses

Reliable bookkeeping is the backbone of any successful small business. It ensures that financial records are up to date, tax obligations are met, a...Read More

The Importance of Precise Bookkeeping for Small Businesses

Managing a small business requires handling multiple responsibilities, and Read More

Corporate Tax & Accounting Services for UAE Small Businesses – OBG Outsourcing

Navigating Corporate Tax & Accounting in the UAE with OBG Outsourcing

The UAE business landscape has evolved significa...Read More

How OBG Outsourcing Inc. Ensures Accurate Financial Records

1. Expert Bookkeeping Services for Businesses

We offer outsourced bookkeeping services to ensure your fin...Read More

Why Timely Bookkeeping is Crucial for Tax Preparation

Timely bookkeeping is essential for maintaining accurate financial records, ensuring tax compliance, and avoiding unnecessary penalties. Without up...Read More

Why CPA Firms Should Consider Professional Payroll Services

CPA firms often provide comprehensive financial solutions to businesses, including tax preparation, bookkeeping, and compliance advisory. However, ...Read More

What Are Prepaid Expenses and Why Do They Matter Before Tax Filing?

In the world of accounting, prepaid expenses play a vital role in ensuring the accuracy of financial records and tax filings. Yet,...Read More

Bookkeeping Review vs Audit Services: What’s the Difference?

Managing financial records is one of the most critical aspects of running a business. Two essential services often sought by businesses to maintain...Read More

Streamline Your Finances with Online Bookkeeping Services: Why OBG Outsourcing Is Your Best Partner

In today’s fast-paced digital world, keeping your finances organized and accurate is essential for running a successful business. However, managi...Read More

Small Business Financial Management: A Guide to Success

Managing finances effectively is the cornerstone of any successful small business. From maintaining accurate records to planning for future growth,...Read More

Accounting Outsourcing Solutions: Streamline Your Financial Operations

In today’s fast-paced business environment, accounting outsourcing services are gaining momentum as a reliable way to manage fin...Read More

What is a Chart of Accounts and How to Create One for Different Businesses?

A chart of accounts (COA) is a systematic listing of all the accounts used in a business's financial system, organized into catego...Read More

Double Entry Accounting Example: A Comprehensive Guide for Accurate Financial Management

What is Double Entry Accounting?

Double entry accounting is a fundamental concept in financial management that ensures eve...Read More

Sales Tax on E-Commerce: Navigating the Complexities and Simplifying Compliance

Sales Tax on E-Commerce: Navigating the Complexities and Simplifying Compliance

With the rapid growth of e-commerce, sales...Read More

Bookkeeping Services for Doctors: Simplifying Financial Management for Healthcare Professionals

Managing a successful medical practice involves more than just delivering exceptional patient care. As a doctor, you also need to ensure that your ...Read More

Bookkeeping Services for Restaurants: Simplifying Financial Management

Running a restaurant is a juggling act—managing staff, inventory, customer satisfaction, and daily operations can be overwhelming. Amidst this hu...Read More

What is Small Business Outsourced Accounting?

How does outsourcing accounting for small businesses work?

Outsourcing accounting for small businesses involves partne...Read More

Why Canadian Accounting Firms Should Consider OBG Outsourcing as Their Trusted Partner

Canada’s accounting landscape is becoming increasingly competitive, with firms juggling the challenges of regulatory compliance, client demands, ...Read More

The Advantages of Outsourcing Payroll: Why It’s a Smart Move for Your Business

Managing payroll is a critical yet time-consuming task for businesses of all sizes. Ensuring compliance, accuracy, and timeliness in payroll proces...Read More

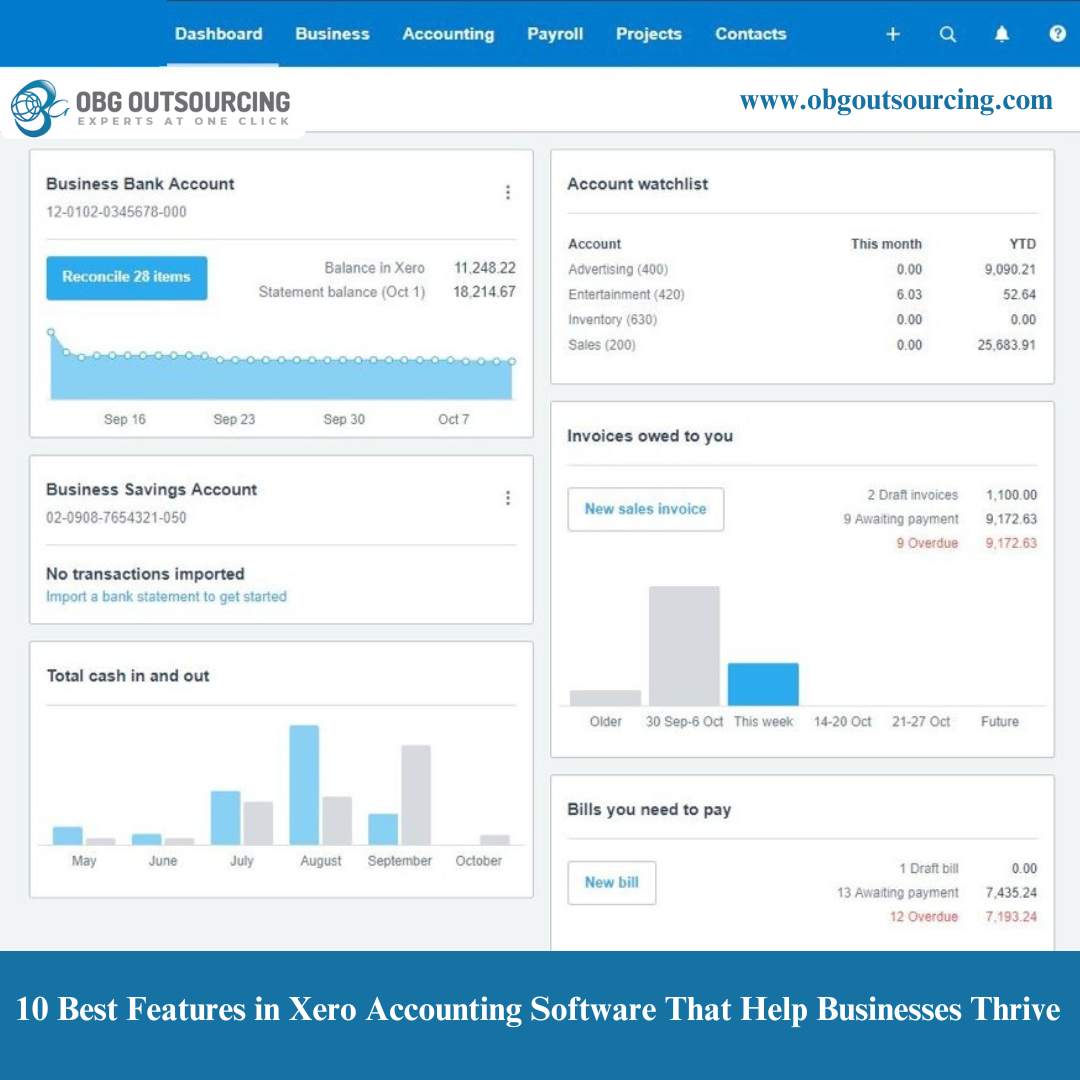

10 Best Features in Xero Accounting Software That Help Businesses Thrive

Managing finances effectively is a critical aspect of running a successful business. Xero, ...Read More

Setting Up a Chart of Accounts for Your Restaurant Business: Common Errors and How OBG Outsourcing Can Help

Setting up a Chart of Accounts (COA) for a restaurant business is crucial for organizing your financial data and ensuring accurate...Read More

How AI is revolutionising Accounting

AI is revolutionizing accounting by automating routine tasks, improving accuracy, and enhancing decision-making processes. With the power of machin...Read More

Ecommerce Tax Accountant Services in the UK: Your Guide to Compliance and Success

In the dynamic world of ecommerce, managing finances and complying with tax regulations can be overwhelming for businesses. Whether you’re a smal...Read More

What is backlog in accounting a comprehensive guide

What is a backlog in accounting?

Backlog meaning in accounting refers to the accumulation of incomplete or unp...Read More

Why US CPA Firms Should Outsource Payroll Services

Outsourcing payroll services can offer significant benefits to US CPA firms looking to improve efficiency, reduce operational costs, and ensure com...Read More

Xero for Beginners: Simplify Your Accounting

Xero for beginners is the perfect tool to simplify your accounting process and streamline financial management. With its user-friendly interface an...Read More

Online Accounting Services for Small Businesses

Online accounting services for small businesses offer a convenient and cost-effective solution to manage your finances with ease. By leveraging clo...Read More

Creative Ways to Pick the Best 1099 Tax Software

1099 preparation and filing is a necessity for small business owners and the self-employed to stay compliant with IRS regulations. As the filing de...Read More

The Ultimate Guide To No Subscription Desktop Accounting Software

The Ultimate Guide to No Subscription Desktop Accounting Software offers small businesses and freelancers a cost-effective solution for managing fi...Read More

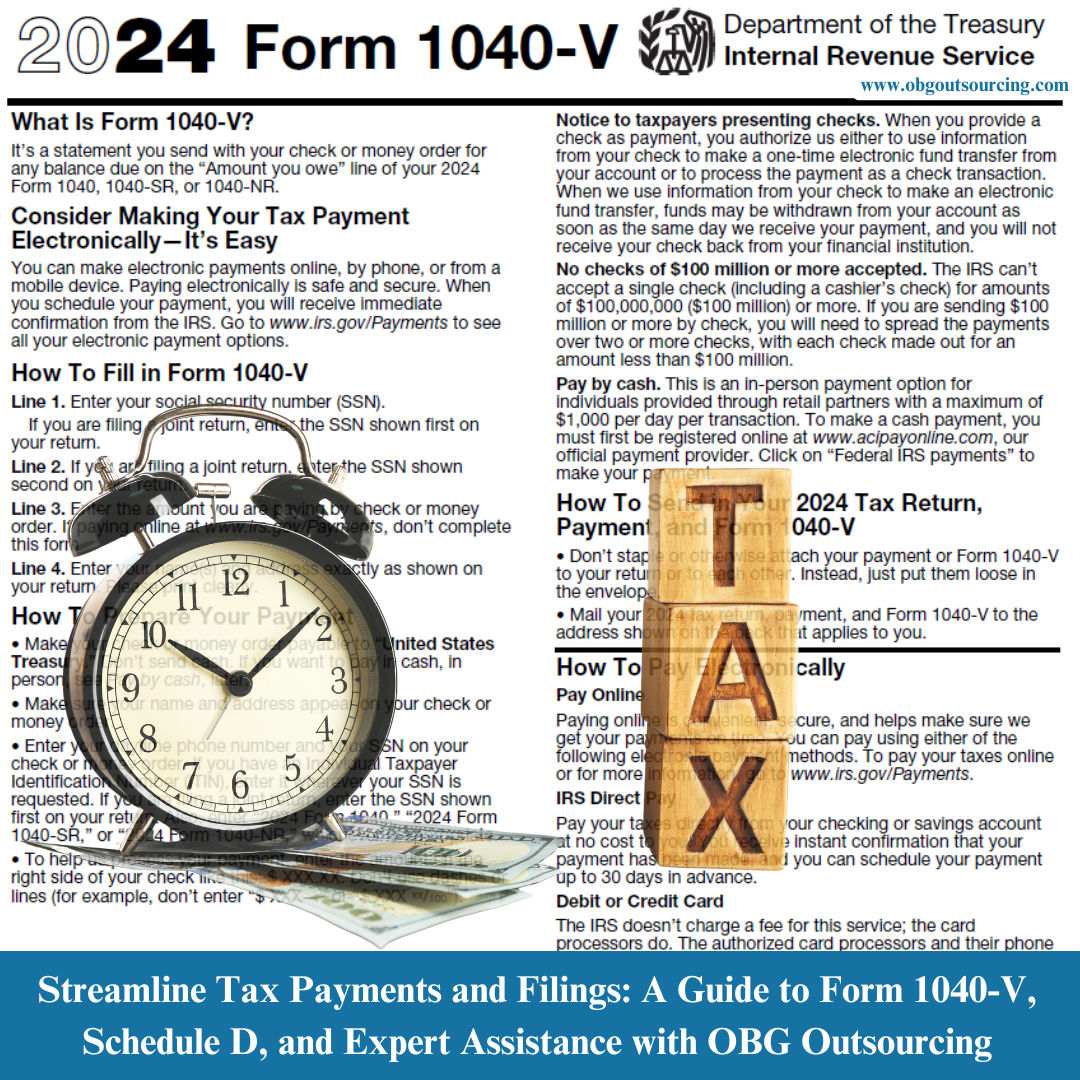

Streamline Tax Payments and Filings: A Guide to Form 1040-V, Schedule D, and Expert Assistance with OBG Outsourcing

Tax payments and filings can be complex for both individuals and businesses. Forms like Form 1040-V and Schedule D may seem intimidating, but under...Read More

Mastering Bank and Credit Card Reconciliation: Essential Guide for Small Businesses with OBG Outsourcing

Accurate Reconciliation Services for Small Businesses with OBG Outsourcing

For small businesses, maintaining accurate fina...Read More

Outsource Accounting & Tax Services for USA & Canada Accountants, CPA Firms, EAs & Accounting Firms

As accountants, CPAs, and EAs navigate the peak workloads during the busy season for accountants, outsourcing accounting and tax services has becom...Read More

Accounting & Bookkeeping Services for Construction Contractors : OBG Outsourcing Private Limited

Managing finances in the construction industry comes with unique challenges like fluctuating project costs, payroll, and tax compliance. Accurate

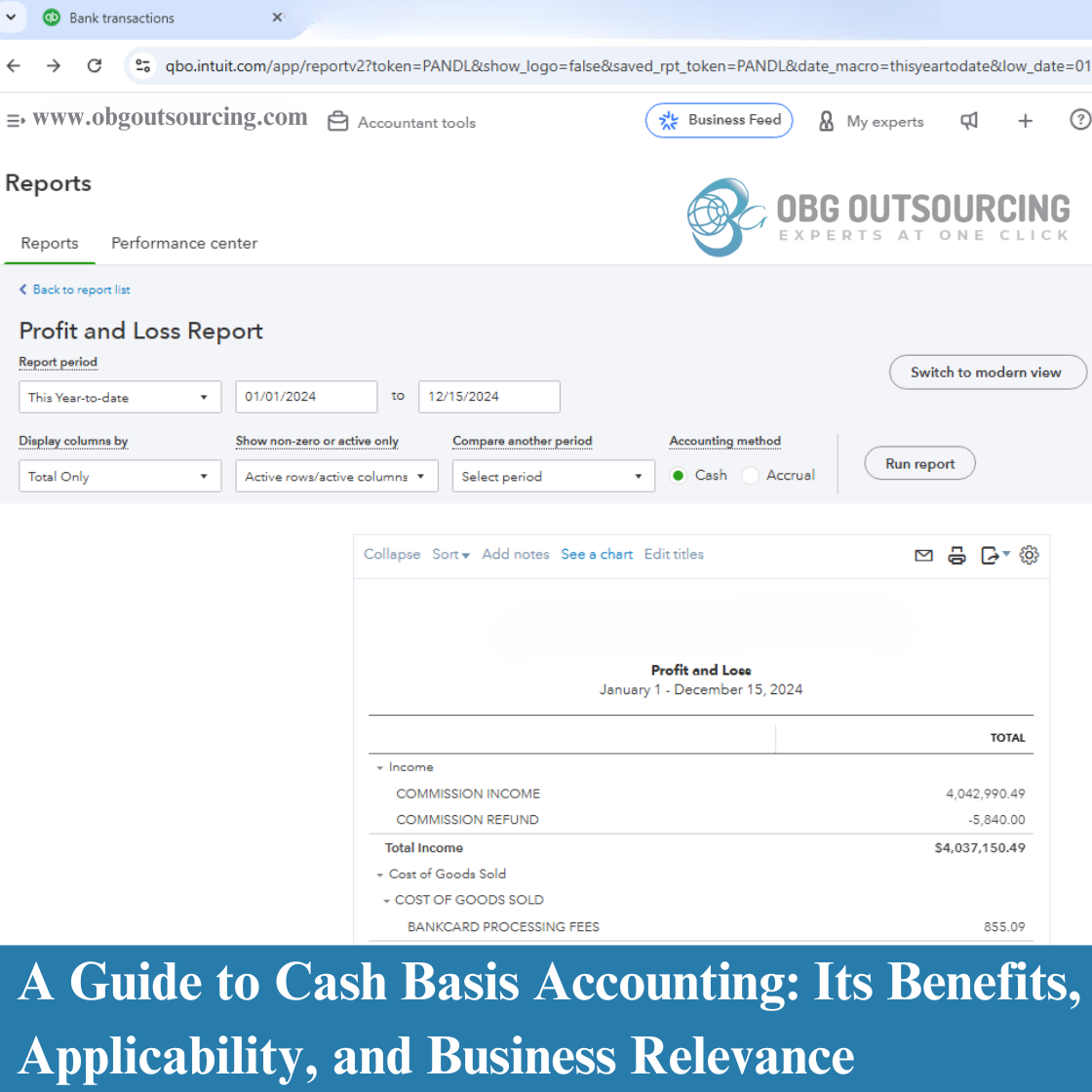

A Guide to Cash Basis Accounting: Its Benefits, Applicability, and Business Relevance

What is Cash Basis Accounting?

In cash basis accounting, revenues and expenses are recorded only when cash is received or ...Read More

Accounting and Bookkeeping Services in USA: Partner with OBG Outsourcing Private Limited

Financial management is crucial for businesses of all sizes in today’s dynamic business environment. Whether you're a small business, startup, or...Read More

Amazon FBA Bookkeeping Made Easy with OBG Outsourcing Private Limited

Managing the financial aspects of your Amazon business is critical, especially when dealing with FBA bookkeeping. Partnering with an expert Amazon ...Read More

Bookkeeping Services in India: Why Outsource Them?

Why Businesses Are Outsourcing Bookkeeping Services to India with OBG Outsourcing Private Limited

Managing finances effect...Read More

Outsourced Accounting for Small Enterprises: A Path to Efficiency and Growth

Outsourcing accounting services is a smart solution for small businesses aiming to optim...Read More

Bookkeeping and Accounting Solutions for Small Businesses in Australia

Managing finances can be challenging for small businesses. Precision in bookkeeping, reliable payroll services, and GST compliance are essential fo...Read More

Learn About the Top Features of Xero Accounting Software

Xero accounting software is a flexible and intuitive solution designed for businesses of all sizes. Its innovat...Read More

Zoho Accounting Software — Features, Benefits, and Secure Access

What is Zoho Accounts?

Zoho Accounts is a cloud-based accounting solution designed to streamline financial management for bu...Read More

US Self-Employed Tax Deductions: Optimize Savings with OBG Outsourcing