What is Cash Basis Accounting?

In cash basis accounting, revenues and expenses are recorded only when cash is received or paid, making it a simple method of accounting. This approach is ideal for small businesses and sole proprietors to manage, unlike accrual accounting, which includes accounts receivable and accounts payable.

Cash Basis of Accounting Meaning

Under cash basis accounting companies typically record revenue only when cash is received and expenses only when cash is paid. This method focuses on immediate cash transactions, offering a real-time view of cash flow.

Advantages of Cash Basis Accounting

Cash basis accounting offers several advantages, particularly for small businesses or individuals looking for a simpler, more straightforward approach to financial management. Here are the key advantages:

Simplicity and Ease of Use

Cash basis bookkeeping requires minimal journal entries, making it perfect for small businesses.

Ideal for business owners with limited accounting expertise.

Clear Cash Flow Visibility

Provides a transparent view of cash flow with real-time updates.

The cash basis balance sheet gives a straightforward snapshot of the financial position.

Tax Advantages

Helps businesses manage tax obligations effectively by recording income when cash is received.

Beneficial for cash basis accounting for tax purposes, reducing tax burdens in some periods.

Cost-Effectiveness

Reduces the need for expensive accounting systems or services, particularly for startups.

Applicability: Who Needs Cash Basis Accounting?

The cash accounting method is best suited for:

Small Businesses: Especially those with low inventory and simple transactions.

Service-Based Businesses: Consulting firms, freelancers, and professionals benefit from cash-based accounting systems.

Businesses Without Inventory: Managing cash basis with inventory can be tricky, so it's more suitable for non-inventory businesses.

Individual Business Owners: A simple and straightforward option for basic financial management.

Examples of benefits of cash accounting

A freelance writer earns $2,000 in March for services provided in February. Cash basis accounting revenue recognition records this income in March, when payment is received.

A graphic designer spends $500 on software in April. The expense is recorded in April, not when the invoice was issued.

Challenges and Limitations

GAAP Non-Compliance

Cash basis GAAP compliance is not possible, making it unsuitable for large corporations requiring audits.

Limited Financial Insight

Excludes accounts receivable and payable, which might obscure the financial picture.

Inventory Management

Cash basis with inventory presents complexities, as inventory costs cannot be matched with revenue.

Conversion to Accrual

Businesses scaling up may need a cash basis to accrual basis conversion, which can be complex.

Why OBG Outsourcing Private Limited for Cash Basis Accounting?

OBG Outsourcing specializes in cash basis bookkeeping services, ensuring accuracy, compliance, and streamlined processes for small businesses.

Key Benefits of Partnering with OBG Outsourcing

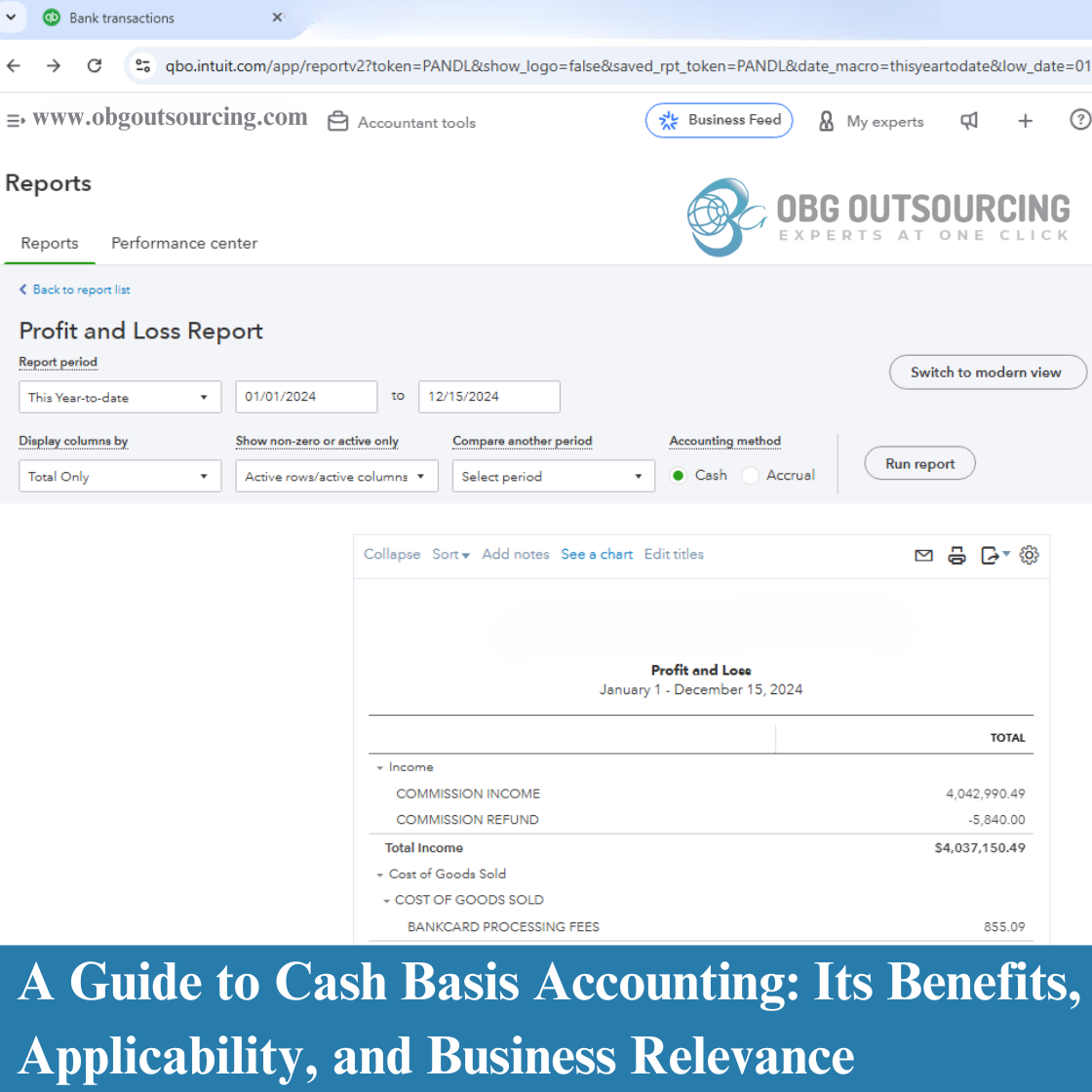

Expertise in cash basis accounting software, including QuickBooks.

Tailored solutions for cash basis businesses, customized to individual needs.

Proficiency in preparing reports like cash basis balance sheets and income statements.

Our Services Include:

Assistance with cash basis accounting for tax purposes.

Support for cash basis accounts receivable journal entry preparation.

Guidance on cash vs. modified cash basis election.

Conclusion: Take Advantage of Cash Basis Accounting

Cash basis accounting offers simplicity, transparency, and tax benefits, making it an excellent choice for small businesses and service providers. Whether you’re starting out or need expert bookkeeping support, OBG Outsourcing Private Limited has the tools and expertise to help you maximize the advantages of cash basis accounting.

Contact Us Today!

Visit our Website

+971-503916508

Let OBG Outsourcing bring you the ultimate benefits of cash basis accounting!

USA

USA UK

UK Australia

Australia UAE

UAE Canada

Canada

_(6).jpg)

_(5).jpg)

.jpg)

_(4).jpg)

_(1).jpg)

_(2).jpg)

.png)

_(8).jpg)